okeyoyna.site News

News

Mission Statement For A Website

There are different approaches to writing a mission statement, but most mission statements will include some combination of the company's goals, values, and. Here is an example of a specific mission statement: “With this blog, the Lion Brand Notebook, we're hoping to connect with you in another way, bringing you. Does your nonprofit website need a page just for your mission statement? Learn how to write a mission and vision page. Amazon's mission is to be Earth's most customer-centric company, Earth's Sustainability Website. Follow Us. Open Item. Follow Us. Twitter. @AmazonNews. No, it is not necessary to have mission, vision, or values statements on your website. Some companies use these documents as part of their. Google's leadership team solved a challenge that not many companies face. Google owned 90% market share in its main business (online search). This massive. A mission statement is a clear and concise summary of your purpose, priorities, and things you need to do each day to reach your goals. A mission statement is a. A good mission statement should only focus on what is most important to the organization. It should be brief, clear, informative, simple and direct. It should. A mission statement is used by a company to explain, in simple and concise terms, its purpose(s) for being. · It is usually one sentence or a short paragraph. There are different approaches to writing a mission statement, but most mission statements will include some combination of the company's goals, values, and. Here is an example of a specific mission statement: “With this blog, the Lion Brand Notebook, we're hoping to connect with you in another way, bringing you. Does your nonprofit website need a page just for your mission statement? Learn how to write a mission and vision page. Amazon's mission is to be Earth's most customer-centric company, Earth's Sustainability Website. Follow Us. Open Item. Follow Us. Twitter. @AmazonNews. No, it is not necessary to have mission, vision, or values statements on your website. Some companies use these documents as part of their. Google's leadership team solved a challenge that not many companies face. Google owned 90% market share in its main business (online search). This massive. A mission statement is a clear and concise summary of your purpose, priorities, and things you need to do each day to reach your goals. A mission statement is a. A good mission statement should only focus on what is most important to the organization. It should be brief, clear, informative, simple and direct. It should. A mission statement is used by a company to explain, in simple and concise terms, its purpose(s) for being. · It is usually one sentence or a short paragraph.

An organization's mission statement describes clearly and concisely why the organization exists – its purpose. The mission statement defines what is important. Mission Statement: “Our mission is to ensure the Internet is a global public resource, open and accessible to all. An Internet that truly puts people first. Does your nonprofit website need a page just for your mission statement? Learn how to write a mission and vision page. These mission statements give examples how some of the world's most successful companies create shared purpose and goals. No, it is not necessary to have mission, vision, or values statements on your website. Some companies use these documents as part of their. Tips for Creating an Effective Mission Statement · Do keep it short and concise. Sum up the company's mission in just a few sentences. · Don't write an essay. A great mission statement should define your brand and its values to the consumers you target for your business and its products and services. A mission statement deals with “why” an organization exists, while a vision statement outlines “what” that existence will eventually look like. A mission. A mission statement focuses on today and what the organization does to achieve it.” Not only should we understand the difference between vision and mission. A mission statement is a strategic piece of messaging that describes how a company plans on achieving its vision. A good mission statement outlines what a. Bring your vision to light! Our mission statement generator is free and easy to use. See examples of the best business mission statements. Our Mission company mission orange our mission our vision ui design website website home page. View Our Mission. Our Mission. Like · Mohammad Asif. We support and promote the development of the Internet as a global technical infrastructure, a resource to enrich people's lives, and a force for good. A mission statement is a short statement that captures the essence of an organization's existence, including its values and goals. Belief creates facts. We believe in augmenting the growth of our clients with superior site development and creative designs. Our vision is to be a leading. A business mission statement is a concise and memorable way to communicate your business goals to clients, employees, and stakeholders. Mission statements are. A mission statement for eCommerce businesses is a succinct, formal declaration or a tagline that communicates the fundamental purpose, values, and objectives. 1) Website Administration → Edit the Principal's Message. 2) Place a checkmark beside the “This is where the school's mission statement” and then click on EDIT. Our mission is to organize the world's information and make it universally accessible and useful. · Explore the latest updates across Android, Gemini and the. Your mission statement should show your company's vision and describe how customers see your business. Here's how to create a mission statement that.

Williams Energy Stock Price

Historical Prices for Williams Companies ; 08/05/24, , , , ; 08/02/24, , , , The Williams Companies, Inc. is a premier energy infrastructure provider in North America. The company's core operations include finding, producing, gathering. Real time Williams Companies (WMB) stock price quote, stock graph, news & analysis. View a financial market summary for WMB including stock price quote, trading volume, volatility, options volume, statistics, and other important company. Is Williams Companies (NYSE:WMB) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing and company. The Williams Companies, Inc.'s stock symbol is WMB and currently trades under NYSE. It's current price per share is approximately $ Discover real-time Williams Companies, Inc. (The) Common Stock (WMB) stock prices, quotes, historical data, news, and Insights for informed trading and. Quote Overview ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: 4,, The Williams Companies Inc stock price today is What Is the Stock Symbol for Williams Companies Inc? The stock ticker symbol for Williams Companies Inc. Historical Prices for Williams Companies ; 08/05/24, , , , ; 08/02/24, , , , The Williams Companies, Inc. is a premier energy infrastructure provider in North America. The company's core operations include finding, producing, gathering. Real time Williams Companies (WMB) stock price quote, stock graph, news & analysis. View a financial market summary for WMB including stock price quote, trading volume, volatility, options volume, statistics, and other important company. Is Williams Companies (NYSE:WMB) a buy? Compare the latest price, visualised quantitative ratios, annual reports, historical dividends, pricing and company. The Williams Companies, Inc.'s stock symbol is WMB and currently trades under NYSE. It's current price per share is approximately $ Discover real-time Williams Companies, Inc. (The) Common Stock (WMB) stock prices, quotes, historical data, news, and Insights for informed trading and. Quote Overview ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: 4,, The Williams Companies Inc stock price today is What Is the Stock Symbol for Williams Companies Inc? The stock ticker symbol for Williams Companies Inc.

The Williams Companies Inc. WMB:NYSE ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High

Williams Companies | WMBStock Price | Live Quote | Historical Chart ; HollyFrontier, , , % ; Keyera, , , %. Get the latest Williams Companies Inc (WMB) real-time quote, historical performance, charts, and other financial information to help you make more informed. Get Williams Companies Inc (WMB-FF:Frankfurt Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Williams Companies (okeyoyna.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Williams Companies | Nyse: WMB | Nyse. Williams Companies Inc WMB ; Valuation · Price/Earnings (Normalized). ; Financial Strength · Quick Ratio. ; Profitability · Return on Assets (Normalized). Aug PM · Williams CEO Says Congress Is Key to Building US Energy Projects. (Bloomberg) ; PM · Analyst Report: The Williams Companies, Inc. . Williams Companies Inc (WMB). + (+%) USD | NYSE | Aug 23, The Williams Companies, Inc. is a premier energy infrastructure provider in North America. The company's core operations include finding, producing. The Williams Cos., Inc. operates as an energy infrastructure company, which explores, produces, transports, sells and processes natural gas and petroleum. Williams Companies okeyoyna.site, WMB · Williams Companies Stock Snapshot · Williams Companies News More News · Historical Prices for Williams Companies · Williams. What was Williams Co's price range in the past 12 months? Williams Co lowest stock price was $ and its highest was $ in the past 12 months. What is. Price History & Performance ; Current Share Price, US$ ; 52 Week High, US$ ; 52 Week Low, US$ ; Beta, The average Williams stock price for the last 52 weeks is For more information on how our historical price data is adjusted see the Stock Price. The current stock price of Williams Companies (WMB) is $ as of September 4, What is the market cap of Williams Companies (WMB)?. The market. Stock analysis for Williams Cos Inc/The (WMB:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. The Williams Companies, Inc., together with its subsidiaries, operates as an energy infrastructure company primarily in the United States. Williams Companies · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (-. Get the latest Williams Companies Inc. (The) (WMB) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Stock price for similar companies or competitors ; Williams Companies Logo. Southwestern Energy. SWN. $, %, USA ; Williams Companies Logo. Sea (Garena). Williams Cos. · AT CLOSE PM EDT 09/04/24 · USD · % · Volume7,,

How Much Is Each Amex Point Worth

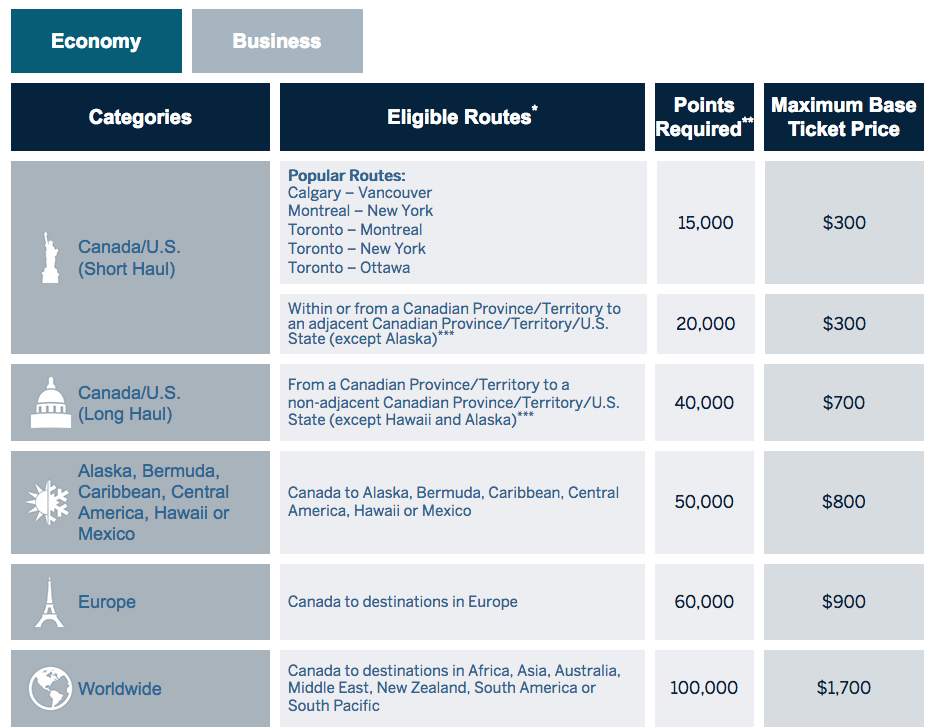

For each conversion of points into the Frequent Flyer program of a U.S. airline, a fee of $ per point, with a maximum fee of $99, will be charged to your. every step of the process when you sell your airline miles. We never compromise How much are Amex points worth? American Express (Amex) points have. The average dollar value of 1 American Express Membership Rewards point is $ Dollar value of 1 point. Flexibility of points. Can points cover taxes and. The Most Valuable Ways to Redeem Amex Points: Get Up to 11 Cents Per Point! In this scenario, each point is worth cents, which is a solid value. For most redemption options, American Express Membership Rewards points are worth no more than 1 cent per point. And some redemptions only provide cents per. This explains the average value of ¢ per point. Redemption, Value. Hotel AMEX Tutorial: How to transfer American Express Membership Rewards points. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. How to Redeem Amex Points for Flights to Europe · Recommended transfer partner: Etihad Guest Miles · Points needed for Business Class: , per person (K. Amex points are only worth.7 cents even when you book through their website, why is this? For each conversion of points into the Frequent Flyer program of a U.S. airline, a fee of $ per point, with a maximum fee of $99, will be charged to your. every step of the process when you sell your airline miles. We never compromise How much are Amex points worth? American Express (Amex) points have. The average dollar value of 1 American Express Membership Rewards point is $ Dollar value of 1 point. Flexibility of points. Can points cover taxes and. The Most Valuable Ways to Redeem Amex Points: Get Up to 11 Cents Per Point! In this scenario, each point is worth cents, which is a solid value. For most redemption options, American Express Membership Rewards points are worth no more than 1 cent per point. And some redemptions only provide cents per. This explains the average value of ¢ per point. Redemption, Value. Hotel AMEX Tutorial: How to transfer American Express Membership Rewards points. American Express reward points are worth anywhere from cents to 2 cents each, depending on how you redeem them. Tip. Using points to shop or for a statement. How to Redeem Amex Points for Flights to Europe · Recommended transfer partner: Etihad Guest Miles · Points needed for Business Class: , per person (K. Amex points are only worth.7 cents even when you book through their website, why is this?

Amex points can generally be redeemed for cents each toward airfare purchases through Amex Travel. As you can see, the value there varies significantly. For. 1X Membership Rewards® points per dollar spent on all other eligible purchases $. Yearly. Monthly. Weekly. Earn 1 Membership Rewards® Point for every2 Rs. 50 spent except for spend on Fuel, Insurance, Utilities, Cash Transactions and EMI conversion at Point of Sale2. Card value calculator. Calculate the value of card benefits and your potential points earn. How much do you spend on your credit card each month? Get started. The value of Membership Rewards points varies according to how you choose to use them. · Standard point values are shown in this chart. · Redemption options and. The value of Membership Rewards points varies according to how you choose to use them. · Standard point values are shown in this chart. · Redemption options and. Amex points are worth ~1 cent, so you've got ~$10, I can think of a couple of things. Take a vacation. A really nice one. Splurge. Upgrade. The simplest way to use Amex points is redeeming them for cash, which you can do as a statement credit to offset your recent purchases. Points are worth only. Assessing the average value of American Express Membership Rewards® is tricky because there are many ways to redeem them. American Express values each point. Redeem points for cash back at a value of 1 cent each (Citi and Amex don't provide as much value for cash back). Credit cards that earn Chase Ultimate. You will get one point for each dollar charged for an eligible purchase on your Platinum Card from American Express. You will get 4 additional points (for a. So redeeming Amex points for cash back or gift cards is typically worth between and one cent per point. That doesn't mean you should avoid these options. Card value calculator. Calculate the value of card benefits and your potential points earn. How much do you spend on your credit card each month? Get started. Amex points are worth ~1 cent, so you've got ~$10, I can think of a couple of things. Take a vacation. A really nice one. Splurge. Upgrade. Membership Rewards Points are generally worth between and 1 cent each, depending on how you redeem them. We recommend using them for travel, whether in the. Dollar value of 1 point. Flexibility of points. Can points cover taxes and fees? ; $ high - You can redeem points against any eligible purchase charged to. The value of gift card redemption depends on the type of gift card you get. In the screenshot below, redemption values vary. If you redeem points for an Amex. Booking a hotel room through Amex Travel generally will not result in great deals. The value that you'll receive is limited to 1 cent per point. That being said. Assessing the average value of American Express Membership Rewards® is tricky because there are many ways to redeem them. American Express values each point. Membership Rewards Points are generally worth between and 1 cent each, depending on how you redeem them. We recommend using them for travel, whether in the.

How To Retire Early

Following these three steps can help you adjust your financial plans if you choose to — or need to — retire sooner than you planned. The tax authorities impose penalties of 10 percent of the taxable portion of retirement plan distributions before age 59 1/2. The definitive guide to financial independence that offers proven skills and realistic strategies you can use to retire early—and still have time to enjoy. If you're considering retiring early, make sure you have a life insurance policy worth 20 times your annual salary, advises Christopher Liew. It turns out there are some interesting benefits to retiring early. Let's look at a few reasons why retiring early might be worth considering. How can I retire early? · Live differently—Save more · Consider a side gig · Test-drive your budget before you retire · Have a plan for health insurance · Take. Best way to retire early/comfortably? · Build a safety net. Usually this is months of expenses. · If available, max out your employer k. How to Retire Early · Practice Your Vision of Retirement. If you have an idea of what you want to do in retirement, consider trying out some of the activities. Realizing your dream of early retirement Figuring out how to retire at 50 isn't easy. You're trying to build more wealth in less time, so naturally, that's. Following these three steps can help you adjust your financial plans if you choose to — or need to — retire sooner than you planned. The tax authorities impose penalties of 10 percent of the taxable portion of retirement plan distributions before age 59 1/2. The definitive guide to financial independence that offers proven skills and realistic strategies you can use to retire early—and still have time to enjoy. If you're considering retiring early, make sure you have a life insurance policy worth 20 times your annual salary, advises Christopher Liew. It turns out there are some interesting benefits to retiring early. Let's look at a few reasons why retiring early might be worth considering. How can I retire early? · Live differently—Save more · Consider a side gig · Test-drive your budget before you retire · Have a plan for health insurance · Take. Best way to retire early/comfortably? · Build a safety net. Usually this is months of expenses. · If available, max out your employer k. How to Retire Early · Practice Your Vision of Retirement. If you have an idea of what you want to do in retirement, consider trying out some of the activities. Realizing your dream of early retirement Figuring out how to retire at 50 isn't easy. You're trying to build more wealth in less time, so naturally, that's.

How to Retire Early · Practice Your Vision of Retirement. If you have an idea of what you want to do in retirement, consider trying out some of the activities. How To Retire Early: Your Guide to Getting Rich Slowly and Retiring on Less [Charlton, Robert, Charlton, Robin] on okeyoyna.site *FREE* shipping on qualifying. See My Related Book · Begin retirement with excess wealth beyond what's necessary to support current lifestyle, so that you have an appropriate cushion. · Earn. Early retirement requires significant savings, often guided by the Rule of 25, which suggests saving 25 times annual expenses. In the case of early retirement, a benefit is reduced 5/9 of one percent for each month before normal retirement age, up to 36 months. If the number of months. We've created a straightforward guide that details 5 ways to retire early. By following the steps that we've outlined, you can develop a customized plan. How To Retire Early: Your Guide to Getting Rich Slowly and Retiring on Less [Charlton, Robert, Charlton, Robin] on okeyoyna.site *FREE* shipping on qualifying. Here is an overview of where to start if you're thinking of retiring early, including our top tips for success. 1 Know your numbers as you plan future expenses in early retirement 2 Make sure you have adequate funds in taxable accounts you can access now 3. FIRE is a movement of people devoted to a program of extreme savings and investment with the goal of retiring far earlier than traditional budgets and. How to Retire Early: Making Accelerated Coal Phaseout Feasible and Just estimates that replacing the entire fleet of global coal plants with clean energy plus. Most UK early retirees pin down their ideal retirement lifestyle, decide when they want it to begin, work out how much they need to fund it, then start saving. The most important tip might be to start saving early and keep at it. “The biggest benefit in any savings plan is time. My claim to fame in the personal finance and early retirement community is my Safe Withdrawal Rate Series, which has now grown to 60 parts. The first step is to estimate how much money you will spend each month once you retire. Start by adding up expenses for things you cannot avoid. How to Retire Early: Making Accelerated Coal Phaseout Feasible and Just estimates that replacing the entire fleet of global coal plants with clean energy plus. Below are ideas to ensure you make a smooth transition into retirement, whether it's this year or in the next few years. On average, Americans retire around age This is the earliest age at which you can begin receiving monthly Social Security benefits. The first step to FIRE retirement planning is determining your target retirement income, which must last for 25 years or more, with an annual withdrawal plan.

Mortgage Rates 20 Year Fixed Loan

New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · % ; year first-time homebuyer with Mortgage Rates Today ; Product: 20 Year Fixed Rate, Resources: Calculate, Rate: % ; Product: 15 Year Fixed Rate, Resources: Calculate, Rate: % ; Product. Average Mortgage Rates, Daily ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. % ; 30 Year Refinance. %. %. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. We offer 10, 15, 20, or Year Fixed Rate Mortgages for home purchase or refinancing. Explore our options to find the home loan that meets your needs. The normal rule when comparing mortgage plans is that a longer term loan will typically have a higher interest rate than a shorter term. For example, a 30 year. Compare year fixed rates from multiple lenders to find the best year mortgage rate. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. year. How Do I Qualify For A Year Fixed Mortgage? · General minimum 3% - % down payment · Minimum - FICO® Score depending on loan type · What you need. New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · % ; year first-time homebuyer with Mortgage Rates Today ; Product: 20 Year Fixed Rate, Resources: Calculate, Rate: % ; Product: 15 Year Fixed Rate, Resources: Calculate, Rate: % ; Product. Average Mortgage Rates, Daily ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. % ; 30 Year Refinance. %. %. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. We offer 10, 15, 20, or Year Fixed Rate Mortgages for home purchase or refinancing. Explore our options to find the home loan that meets your needs. The normal rule when comparing mortgage plans is that a longer term loan will typically have a higher interest rate than a shorter term. For example, a 30 year. Compare year fixed rates from multiple lenders to find the best year mortgage rate. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %. year. How Do I Qualify For A Year Fixed Mortgage? · General minimum 3% - % down payment · Minimum - FICO® Score depending on loan type · What you need.

Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · %. Today's year fixed mortgage rates. % Rate. % APR. Learn how Conventional fixed-rate loans. Term. Toggletip Icon. The term is the amount of. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. (1) Your loan is one of the following fixed-rate mortgage loan products: Homebuyers Choice, Military Choice, or and year Jumbo Fixed loans (collectively. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Year Fixed-Rate Home Equity Loan. Up to $, % ; Year Investment-Property Mortgage. Fixed Rate, Conforming or Jumbo. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. yr fixed. Rate. %. APR. Here's an example of amortization during the first year of a year fixed loan of $k with a 5% interest rate. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Interest Rate, APR. Year Fixed Rate, %, %. Year Fixed Rate, %, %. Year Fixed Rate, %, %. Year Fixed Rate, %, %. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. As of Aug. 27, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. The PMMS is focused on conventional, conforming fully-amortizing home purchase loans for borrowers who put 20% down and have excellent credit The Year. For a year loan of $,, you would make payments of $ 1, at % APR, followed by payments based on the then-current variable rate. Loan. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. Buying A Home Refinancing. Year Fixed. Rate%. /. APR%. Points. (). What are APR and points? Apply To Prequalify · Learn About Year Fixed Loans. Year. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1,

What House Mortgage Can I Afford

Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. When you're buying a home, mortgage lenders don't look just at your income, assets, and the down payment you have. They look at all of your liabilities and. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. Our free home affordability calculator will do the math for you, that way you can house hunt for something that fits perfectly into your budget. Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. When you're buying a home, mortgage lenders don't look just at your income, assets, and the down payment you have. They look at all of your liabilities and. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. Our free home affordability calculator will do the math for you, that way you can house hunt for something that fits perfectly into your budget.

Want to know how much house you can afford? Use our home affordability calculator to determine the maximum home loan amount you can afford to purchase. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Knowing how much house you can afford is a matter of comparing your financial situation to the factors lenders consider when approving a mortgage. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Based on information provided, you may be able to afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Your monthly payments which included house hold expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. If you have a spouse or a partner that has an income which will also contribute to the monthly mortgage, make sure to include that as well into your gross. Use the LendingTree home affordability calculator to help you analyze multiple scenarios and mortgage types to find out how much house you can afford. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. How Much of a Mortgage Can I Afford? Generally speaking, most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-. A DTI ratio is your monthly expenses compared to your monthly gross income. Lenders consider monthly housing expenses as a percentage of income and total. Lenders use a debt-to-income ratio to determine the mortgage amount you can afford. Many prefer to see a ratio no larger than 36%; however, some will allow a.

Blue Cash Preferred Card From American Express Annual Fee

With a $0 introductory annual fee (then $95 annually thereafter; see rates and fees), you'll enjoy perks like monthly statement credits toward Disney+ purchases. Get Your First Additional Platinum Card for No Annual Fee Share benefits of Platinum Card® Membership when you add an Additional Card to your account. They earn. Earn a $ statement credit after you spend $3, in eligible purchases on your new Card within the first 6 months. $0 intro annual fee for the first year. With no annual fee, a low APR, and generous cash back rewards, it's hard to beat this card for its value. Before you decide whether or not this is the right. Annual fee: $0 intro annual fee for the first year, then $ · Welcome bonus: · Rewards: · APR: · Other perks and benefits: · Does the issuer offer a preapproval. There's a $0 intro annual fee for the first year, then $ There's also a 0% introductory APR offer. You'll get Cash Back in the form of Reward Dollars that. No Annual Fee Credit Cards · Credit Intel – Financial Education Center Blue Cash Preferred® Card from American Express. Blue Cash Preferred Card. Only U.S.-issued American Express Consumer and Business Cards and registered American Express Serve® and Bluebird cards may be eligible. We may consider the. No Annual Fee Credit Cards · Credit Intel – Financial Education Center Blue Cash Preferred® Card from American Express. Blue Cash Preferred Card. With a $0 introductory annual fee (then $95 annually thereafter; see rates and fees), you'll enjoy perks like monthly statement credits toward Disney+ purchases. Get Your First Additional Platinum Card for No Annual Fee Share benefits of Platinum Card® Membership when you add an Additional Card to your account. They earn. Earn a $ statement credit after you spend $3, in eligible purchases on your new Card within the first 6 months. $0 intro annual fee for the first year. With no annual fee, a low APR, and generous cash back rewards, it's hard to beat this card for its value. Before you decide whether or not this is the right. Annual fee: $0 intro annual fee for the first year, then $ · Welcome bonus: · Rewards: · APR: · Other perks and benefits: · Does the issuer offer a preapproval. There's a $0 intro annual fee for the first year, then $ There's also a 0% introductory APR offer. You'll get Cash Back in the form of Reward Dollars that. No Annual Fee Credit Cards · Credit Intel – Financial Education Center Blue Cash Preferred® Card from American Express. Blue Cash Preferred Card. Only U.S.-issued American Express Consumer and Business Cards and registered American Express Serve® and Bluebird cards may be eligible. We may consider the. No Annual Fee Credit Cards · Credit Intel – Financial Education Center Blue Cash Preferred® Card from American Express. Blue Cash Preferred Card.

Fees · The Blue Cash Preferred Card from American Express has an $0 introductory annual fee for the first year, then $ (). · There is an introductory 0% APR. Blue Cash Preferred® Card from American Express $0 intro annual fee for the first year, then $ Earn a $ statement credit after you spend $3, in. $0 intro annual fee for the first year, then $ Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It® to split up large purchases into monthly. However, the Blue cash Preferred card from American Express comes with a $0 annual fee, and then you pay $ Each card offers a 0% initial APR for purchases. Annual Fee: $95 $0 introductory annual fee for your first year, then $ Terms Apply. | Rates & Fees. How to Earn Rewards. There is a $0 intro annual fee for the first year, then $ Cardholders earn 6% Cash Back at U.S. supermarkets on up to $6, per year in purchases (then 1%). What's more, all Cards – Cash Magnet, Blue Cash Everyday, and Blue Cash Preferred – allow new Card Members to enjoy $0 introductory Plan It® fees9,10,12 for. Know if you're approved for a Card with no impact to your credit score · All Cards · Featured · Travel · Cash Back · Rewards Points · No Annual Fee · 0% Intro APR · No. With no annual fee, a low APR, and generous cash back rewards, it's hard to beat this card for its value. Before you decide whether or not this is the right. Blue Cash Preferred Annual Fee. $0 intro 1st yr, $95 after · Blue Cash Preferred APR on Purchases. 0% intro APR for 12 months, % - % (V) APR after that. Is the Blue Cash Preferred® Card from American Express worth the $95 annual fee (waived first year)? = cash back - annual fee + retention/welcome offer. Earn a $ statement credit after you spend $3, in eligible purchases on your new Card within the first 6 months. · $0 intro annual fee for the first year. $84 Disney Bundle Credit: With your enrolled Blue Cash Preferred Card, spend $ or more each month on an auto-renewing Disney Bundle subscription, to receive. There is a $0 intro annual fee for the first year, then $ Cardholders earn 6% Cash Back at U.S. supermarkets on up to $6, per year in purchases (then 1%). $0 intro annual fee for the first year, then $ Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It® to split up large purchases into monthly. Annual Fee – The Amex Blue Cash Preferred® Card has an intro annual fee of $0, then $ · Rewards Redeemed as Statement Credit – The cash back you earn using. The Blue Cash Preferred has an annual fee, but in exchange, you get a more robust cash back earning potential with more categories and higher rates. In our. The annual fee for the Blue Cash Preferred® from American Express is $ There is no annual fee for Additional Cards. *Terms and Conditions for the Membership. Annual Fee & Perks: With an annual fee of $95, the card also includes travel benefits like up to a $ credit for Global Entry or TSA PreCheck® and travel.

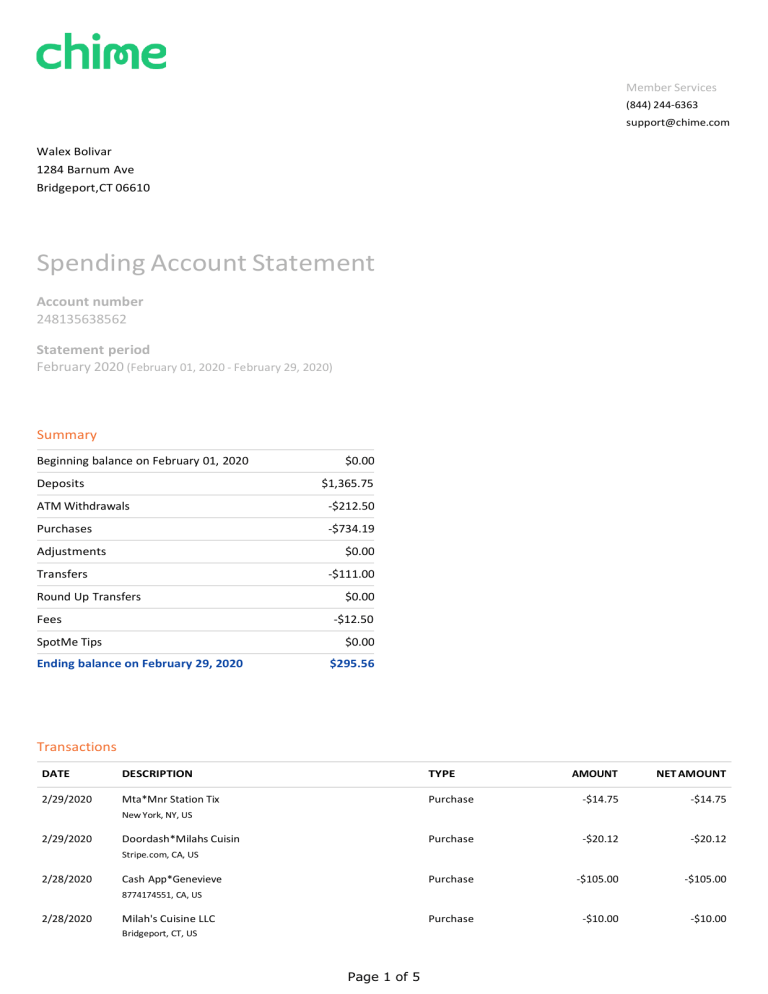

Chime Daily Spending Limit

Chime's SpotMe feature lets you make debit card purchases and cash withdrawals that overdraw your account with no overdraft fees. Limits start at $20 and can. The maximum account balance for any single True Link Visa Card is $20, The maximum load limit per day is $5, Can I temporarily stop using True Link. There is a $ fee every time you withdraw cash this way with a limit of up to $ per day. Any fees incurred including ATM and over-the-counter withdrawals. Chime® is an excellent financial app and online account (/10) that Monito roundly recommends for everyday spending and in-network ATM withdrawals in the. There is one exception: Individual payments greater than $10, won't be sent via same-day transfer or instant transfers. When this occurs, these payments will. Limits can increase as soon as the next pay cycle. Continue to use Chime and within a few months you could reach higher credit limits, up to $ You can withdraw up to $ a day from your Chime account using an ATM. This $ and any fees you incur from out-of-network withdrawals count toward the $2, The card is connected to your account, and your spending limit is based on your available funds. Many virtual debit cards allow users to set a maximum spend. Set up daily limit of up to $ or more based on Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Chime's SpotMe feature lets you make debit card purchases and cash withdrawals that overdraw your account with no overdraft fees. Limits start at $20 and can. The maximum account balance for any single True Link Visa Card is $20, The maximum load limit per day is $5, Can I temporarily stop using True Link. There is a $ fee every time you withdraw cash this way with a limit of up to $ per day. Any fees incurred including ATM and over-the-counter withdrawals. Chime® is an excellent financial app and online account (/10) that Monito roundly recommends for everyday spending and in-network ATM withdrawals in the. There is one exception: Individual payments greater than $10, won't be sent via same-day transfer or instant transfers. When this occurs, these payments will. Limits can increase as soon as the next pay cycle. Continue to use Chime and within a few months you could reach higher credit limits, up to $ You can withdraw up to $ a day from your Chime account using an ATM. This $ and any fees you incur from out-of-network withdrawals count toward the $2, The card is connected to your account, and your spending limit is based on your available funds. Many virtual debit cards allow users to set a maximum spend. Set up daily limit of up to $ or more based on Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors.

However, putting less money into your Chime security deposit will result in a lower credit card limit. You can get started with a $50 security deposit, but then. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. We have a daily deposit limit of up to $2, for personal accounts. If you have a business account, you will have a daily deposit limit of $25, Of. You might be hitting a daily spending limit that you didn't realize was in place +1––– For help with this issue, call the CHIME. Your secured Credit Builder card has an ATM withdrawal limit of $ per day To view your spending and withdrawal limits in your Chime app: Go to. The money you move into your credit builder secured account sets your spending limit, so it's entirely under your control. day. You can also earn 5. Debit cards usually have daily purchase limits, meaning you can't spend more than a certain amount in one hour period Debit cards draw the funds. Boosts last until the first day limit of up to $ or more based on member's Chime account history, direct deposit frequency and amount, spending activity. When we looked at their credit file, we realized that the balance on their chime credit card. was pretty high. When we informed them that they've been spending. There's no credit check, no annual fees or APR. Your spending limit is determined by the amount of money you move to the Credit Builder card from your Chime®. Chime imposes daily spending limits on its accounts to ensure security and prevent fraud. For the Chime Visa Debit Card, the daily purchase. Be informed that Chime users can spend $ a day through Chime ATM card. But, it is also worth noting that fees on cash withdrawal via Chime VISA card also. All Members can withdraw $ per day at over 60k+ fee-free ATMs and up to $2, per day at cash back locations such as Walmart. PM · May. It doesn't charge overdraft fees or service fees and doesn't have minimum balance requirements. Chime has been estimated to be the largest neobank in the US. This app is available only on the App Store for iPhone. Chime – Mobile Banking 4+. Save, Spend, Build Credit. Limits can increase as soon as the next pay cycle. Continue to use Chime and within a few months you could reach higher credit limits, up to $ Spend Better · Build credit with everyday purchases · Get paid up to 2 days faster · Get fee-free overdraft · Earn points on swipes for cash back · 40,+ fee-free. Eligible members may be offered a $20 - $ Credit Limit per pay period. Your Credit Limit and Maximum Available Advance will be displayed to you within the. everyday Americans can make progress. spending activity and other risk-based factors. Your SpotMe Limit will be displayed to you within the Chime mobile app. Set a budget and track your spending in eight everyday categories. Receive alerts2 when your spending reaches the limit you set for each category. Fraud.

Is Collecting Gold Coins A Good Investment

.jpg)

Precious metals isn't an investment, it's an inflation proof way of holding your money. If you just want precious metals to hold value against. Of course, with both coins and bars, at some point you may wish to sell them in order to 'liquidate' your investment. One of the other benefits of gold is that. Gold coins are purer than gold jewellery and fetch a better price. Gold coins are easier to buy and sell and have greater resale value. This is another factor worth taking into consideration when buying gold, where coins could potentially provide you with greater return on investment, bullion. if you're looking for quick returns, no it's not a good investment. If you're looking for long term wealth storage, it's great. With most numismatic gold and silver coins, their value as a collectible is often far higher than the value of their metal content. But, they aren't investment. Anyone who has ever been lucky enough to own gold coins will understand that there's something solid and satisfying about investing in sovereigns. Gold coins are a good investment. Gold coins are ideal when an individual is looking to preserve their assets in the long term. Gold is seen as a hedge against inflation and a store of value through market ups and downs. Investors can hold physical gold directly as coins, bullion, or. Precious metals isn't an investment, it's an inflation proof way of holding your money. If you just want precious metals to hold value against. Of course, with both coins and bars, at some point you may wish to sell them in order to 'liquidate' your investment. One of the other benefits of gold is that. Gold coins are purer than gold jewellery and fetch a better price. Gold coins are easier to buy and sell and have greater resale value. This is another factor worth taking into consideration when buying gold, where coins could potentially provide you with greater return on investment, bullion. if you're looking for quick returns, no it's not a good investment. If you're looking for long term wealth storage, it's great. With most numismatic gold and silver coins, their value as a collectible is often far higher than the value of their metal content. But, they aren't investment. Anyone who has ever been lucky enough to own gold coins will understand that there's something solid and satisfying about investing in sovereigns. Gold coins are a good investment. Gold coins are ideal when an individual is looking to preserve their assets in the long term. Gold is seen as a hedge against inflation and a store of value through market ups and downs. Investors can hold physical gold directly as coins, bullion, or.

In terms of liquidity, fractional gold coins are great as they offer good bartering opportunities, which is not always possible with gold coins that contain a. Buying Gold is a great way to hedge against inflation and preserve the value of your investment even when the dollar's worth fluctuates. Additionally, Gold. Coins made from gold and silver are often worth more than their face value. For the most part, collecting coins is likely to be more of a hobby than an. The most common answer to this question is usually "a secure investment that will give me a good return when I decide to sell it." When world markets are. There is a strong argument to be made that gold coins are the best option for smaller investors into gold. They can be free from Capital Gains Tax. Compared to a stock's value, investing in gold coins is cheaper than buying a house. For first-time investors, investing in gold coins is good. Investing in physical gold and silver has long been a healthy addition to any portfolio, putting the brakes on inflation, mitigating tough economic times. Keeping your gold in a professional gold storage facility is the better option, offering security, insurance, and opportunities to scale your investment. Risk. Gold sovereigns are a good investment because the coin is capital gains tax-exempt in the United Kingdom. Extensive data available on the prices and auction. The premium is one of the biggest factors to consider when choosing between gold bars or coins. At smaller size investments however, particularly 1oz and under. You could go straight to the wholesale markets and buy more reliable, safer and cheaper Good Delivery bullion which you will quickly find is also much easier to. The value of these coins is based on the current market price of gold, making them a good investment choice. Some of the more popular bullion coins include the. Investing in gold may provide investors with a hedge against inflation and economic uncertainty. It can also diversify an investment portfolio, reducing. As such, making more profit on the gold coins is much easier on gold coins than on silver coins. It is, therefore, safe to note that old coins whether gold or. One of the most compelling reasons to buy gold coins is their physicality. Unlike stocks or bonds, gold coins are tangible assets. No matter the state of the world economy, gold is always a wise investment because its value is relatively stable. The price of gold hasn't dropped below. No matter the state of the world economy, gold is always a wise investment because its value is relatively stable. The price of gold hasn't dropped below. Unlike bullion, digital gold does attract capital gains tax, but it is all physically backed by real gold deposits. Remember, as with all investments, your. Collecting coins can be lucrative. A $5 'Half Eagle' gold piece coin from sold in an auction last year for $m (£m). The Knight Frank Luxury. For most people, standard bullion coins are a simpler and safer investment. Depending on where you are based, one of the best reasons to invest in gold coins is.

How Dark Pools Work

Dark pools are methods of connecting large buyers and sellers outside of the public market. Dark Pools are private exchanges that operate outside of the traditional stock market, providing a way for institutional investors to trade large blocks of. Dark pools allow investors to trade without any public exposure until after the trade is executed and cleared. Dark Pool" is an unofficial term often used to refer to an ATS that is not lit, meaning it doesn't publicly display pre-trade quotation data the way exchanges. They are called dark pools because of their complete lack of transparency and regulation. Such murky waters have become prime hunting ground for more predatory. Institutional investors can purchase and sell big blocks of securities on secret electronic trading platforms known as "dark pools" without disclosing the. Dark pools are private exchanges for trading securities that are not accessible to the investing public. Dark pools were created to facilitate. Dark pools work by allowing buyers and sellers to place orders anonymously. The pool operator matches buyers and sellers based on various factors, such as the. In finance, a dark pool (also black pool) is a private forum (alternative trading system or ATS) for trading securities, derivatives, and other financial. Dark pools are methods of connecting large buyers and sellers outside of the public market. Dark Pools are private exchanges that operate outside of the traditional stock market, providing a way for institutional investors to trade large blocks of. Dark pools allow investors to trade without any public exposure until after the trade is executed and cleared. Dark Pool" is an unofficial term often used to refer to an ATS that is not lit, meaning it doesn't publicly display pre-trade quotation data the way exchanges. They are called dark pools because of their complete lack of transparency and regulation. Such murky waters have become prime hunting ground for more predatory. Institutional investors can purchase and sell big blocks of securities on secret electronic trading platforms known as "dark pools" without disclosing the. Dark pools are private exchanges for trading securities that are not accessible to the investing public. Dark pools were created to facilitate. Dark pools work by allowing buyers and sellers to place orders anonymously. The pool operator matches buyers and sellers based on various factors, such as the. In finance, a dark pool (also black pool) is a private forum (alternative trading system or ATS) for trading securities, derivatives, and other financial.

If a gamer is trading in dark pool A and sees that dark pool B sends Only when a full and complete understanding of how the Dark Pools work and a clear. How Does Dark Pool Trading Work? Principally, dark pool trading exists for large-scale investors that don't want to influence the market through their trades. Dark Pools are maintained by brokers where institutional traders can rest hidden orders work as expected. The information does not usually directly identify. First, what is a dark pool? The technical term for them is ATS (alternative trading system). They are essentially mini exchanges that match buy and sell orders. In finance, a dark pool (also black pool) is a private forum for trading securities, derivatives, and other financial instruments. MS POOL is a real-time continuous match dark liquidity pool. It matches eligible orders at or within the best bid and offer, attempting midpoint execution or as. Dark pools are alternative trading systems that allow institutional investors to execute large trades without causing significant market impact. To start with the basics, dark pools are alternative trading venues (i.e. not exchanges) where different participants can place bids and offers (also known as. Cryptocurrency dark pools: These are similar to those in the stock market and securities. They operate to match buyers and sellers of large dark pool orders. Dark pools allow trading outside public exchanges. They're usually used by institutions to place massive orders without impacting the market. Dark pools are private exchanges for trading securities that are not accessible to the investing public. · Dark pools were created to facilitate. Dark pools work pretty much the same way public stock exchanges work. Buyers and sellers converge to trade securities. Only that the participants are “big money. Dark pools are networks – usually private exchanges or forums – that allow institutional investors to buy or sell large amounts of stock without the details. Cryptocurrency dark pools: These are similar to those in the stock market and securities. They operate to match buyers and sellers of large dark pool orders. Dark pools are like the "secret societies" of the stock market. They allow investors to place large trades without alerting the market to their intentions. Dark pools work pretty much the same way public stock exchanges work. Buyers and sellers converge to trade securities. Only that the participants are “big money. A dark pool is a private financial exchange where institutional investors, such as large banks, hedge funds, and mutual funds, trade stocks. In Europe, the Markets in Financial Instruments Directive (MiFID II) works to increase transparency and reduce the risk of market manipulation in dark pools. MS POOL is a real-time continuous match dark liquidity pool. It matches eligible orders at or within the best bid and offer, attempting midpoint execution or as. Dark Pool" is an unofficial term often used to refer to an ATS that is not lit, meaning it doesn't publicly display pre-trade quotation data the way exchanges.